Coronavirus stimulus bill mandates will cripple Texas small businesses: Representative

Rep. Chip Roy, R-Texas, says he’s spoken with small business owners in Texas and they are concerned about getting capital and want as few restrictions as possible to keep their businesses up and running.

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

Continue Reading Below

Small businesses across the country are being forced to shutter and even lay off employees as the coronavirus pandemic causes all but the most essential businesses to close.

Cities and states, as well as the federal government, are offering relief to these employers. Treasury Secretary Steven Mnuchin said Friday the small business relief included in the massive $2 trillion coronavirus stimulus package could keep 50 percent of Americans at work.

DOES BUSINESS INSURANCE COVER CORONAVIRUS-RELATED LOSSES?

The largest relief bill in recent memory includes more than $370 billion in funding for small businesses.

Here's how cities and states hit hardest by the pandemic are responding.

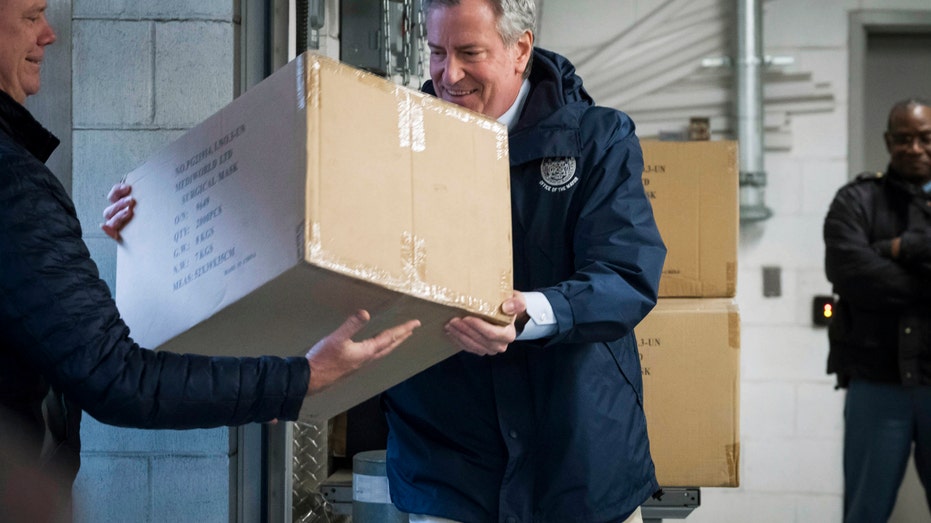

In this March 28, 2020 photo provided by the New York City Mayoral Photography Office, NYC Mayor Bill de Blasio helps load a carton containing some of 250,000 face masks into a truck on a loading dock at U.N. headquarters. (Ed Reed/Mayoral Photograph New York City New York City, which is considered a virus hot zone with more than 33,000 cases, has launched the NYC Small Business Continuity Loan Program. The program provides interest-free loans up to $75,000 for New York City businesses with fewer than 100 employees "that can demonstrate at least a 25% decrease in revenue as a result" of coronavirus. California Small businesses in California can obtain loans through the California Capital Access Program, or CalCAP. Since early March, CalCAP has been allowing supplemental contributions for credit enhancements for loans if the businesses can prove they are directly affected by the pandemic. CalCAP for Small Business applies to firms with fewer than 500 full-time employees. Pedestrians walk through an empty parking leot at Venice Beach, Saturday, March 28, 2020, in Los Angeles. (AP Photo/Mark J. Terrill) Some California businesses are also expected to seek help from the Small Business Administration's Disaster Loan Program. The program has a section known as the Economic Injury Disaster Loan program, which can help qualified small businesses. In order to qualify for such a loan, a business must prove substantial economic injury – that it is unable to pay its ordinary and necessary operating expenses. The point of the loan is to help a business ride out a disaster period until normal operations can resume. It applies to situations where there is no physical damage. California exceeds 5,600 confirmed coronavirus cases. CLICK HERE TO READ MORE ON FOX BUSINESS Louisiana Louisiana small businesses have access to SBA disaster funds as of last week after the state's disaster declaration. The state has the third-highest number of deaths with 151. Its total cases number 3,315. In this Thursday, March 19, 2020, file photo, a view of the nearly deserted Bourbon Street, which is normally bustling with tourists and revelers, is seen in the French Quarter of New Orleans. (AP Photo/Gerald Herbert, File) Washington state Small businesses in Washington state, regardless of county, can apply for SBA disaster loans as of late March. There are 4,319 confirmed cases in Washington state and 189 deaths. In King County, home to Seattle, there are 2,077 confirmed cases and 136 deaths, according to the latest research from Johns Hopkins University. In addition, the City of Seattle Small Business Stabilization Fund is an emergency fund that provides working grants of up to $10,000 to qualifying small businesses. Business owners must have income that is less than or equal to 80 percent of the area median income, five employees or less, a physical establishment and must be able to prove loss of income due to the pandemic. GET FOX BUSINESS ON THE GO BY CLICKING HERE Source: Read Full Article