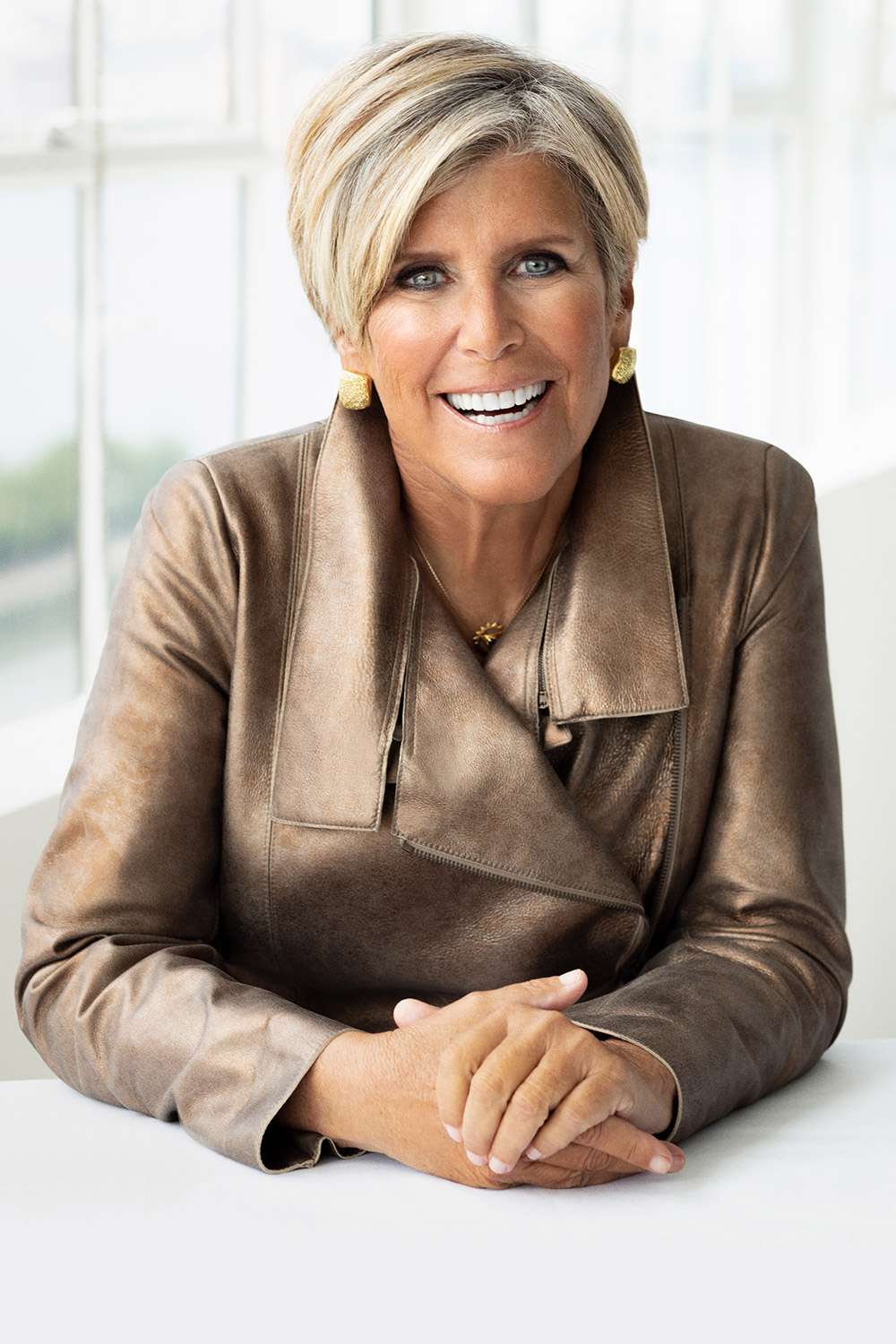

DO: Consider Refinancing Your Home

Interest rates are falling – now might be a good time to refinance your mortgage.

If the current interest rate is more than one percentage point lower than your current interest rate, call your mortgage broker.

However, “do not refinance and extend your years,” Orman cautions. If you plan to stay in your home, the long-term goal is to pay off your mortgage sooner. And with the lower interest rates, you may even be able to get a 15-year mortgage for the same (or lower!) monthly payment you’re currently making on a 30-year mortgage.

DO: Keep Your Money in the Bank

Don’t run to the bank and empty all your savings and checking accounts. The fact is, your money isn’t safer stuffed under your mattress or in a secret cereal box in your kitchen cabinet.

“Banks and credit unions are insured up to $250,000,” Orman says. But most homeowner’s or renter’s insurance policies only cover cash money loss up to about $500.

“If someone breaks in and steals it, or if you have a fire, or a flood, you are going to be out of the money,” she says. “And there’s far more chance of that happening. Don’t do it.”

If, however, you have more than $250,000 in your checking or savings account – then Orman suggests opening accounts with $250,000 each at different banking institutions.

“Not another branch of the same bank, but a different bank all together,” she adds.

DO: Hold off on Any Non-Essential Spending

Thinking about renovating your kitchen? Or taking out a home equity line of credit and putting a pool in your backyard? Perhaps you’re thinking that while you’re home from work, you could supervise a project – and it would take your mind off things.

But don’t do it, Orman says.

You may need that home equity line of credit to pay your bills if the virus continues to spread, and you are out of work.

“Suspend any big project,” she says. “Stop it right now.”

Thinking about buying a new car?

Kick that down the road, too, she says. Only buy essentials.

“You have to be really smart about this,” Orman says. “You have to look at your current financial situation. How much debt do you have? Is your job going to come back? What’s going to happen? You need to think about every single penny you’re spending right now.”

DO: Avoid Retail Therapy

Stuck at home, you may have a lot more time to really dig through eBay or click through every section of Zullily.

“Do not go on all of these online sites to shop for things because you’re bored,” Orman says.

The only things you want to buy right now, she says, are essential items. Shopping online for groceries is great: It helps with social distancing, and food is an essential item.

DON’T: Panic and Empty Your Retirement Accounts. Don’t Even Touch Your Retirement Accounts

Max out your credit cards before you touch a penny of your retirement accounts, Orman says.

Normally, accruing credit card debt is not Orman’s advice. But do not touch your retirement accounts, she urges. Worst case scenario, she says, you can declare bankruptcy to wipe out credit card debt. But, even if you declare bankruptcy, your retirement accounts will be safe.

“Your retirement accounts are totally protected,” Orman says. “You could have $10 million in a 401K, and claim bankruptcy, and it can’t touch it.”

Once more, for those still considering it: Leave your retirement accounts alone, she urges.

“I’m getting too many emails from people saying, ‘Suze, I’m going to totally take all of my money out of my 401K plan and keep it safe and sound.’ Or, ‘I’m going to pay off the mortgage on my home,’” she tells PEOPLE. “Are you crazy? You can’t do things like that.”

Don’t take a loan from your 401K, she says.

“Please be aware that many employers will not match your contribution if you have a loan outstanding,” she says. “So be very careful before you do that.”

One reason Orman has always been a proponent of Roth IRAs, is that you can withdraw money you have contributed without having to pay taxes or penalties. For example, if you’ve put $5,000 into your Roth account, and it’s currently worth $10,000, you can withdraw $5,000 tax-free, regardless of your age, or how long the money has been invested.

And yet: Wait until you “have no other choice” to touch that Roth contribution, Orman says. That’s only “if you have maxed out your credit card, and you don’t have any opportunity to go back to work, and you have to feed your kids.”

She’s so adamant that you leave your retirement accounts alone that she recommends, if you still have a paycheck coming in, that you keep contributing to them – especially if your employer is matching contributions.

DO: Ask for Help

Don’t wait for invoices to stack up unpaid. Reach out to creditors and ask for help paying your bills, Orman says.

“You are not to sit there and be afraid that you won’t have the money to pay the bill. Take action,” Orman says. “If you have a mortgage, or a landlord, or utility bills or credit cards, or student loans – call, today, every one of your creditors and ask for a moratorium on your payments because you don’t have an income coming in, because you have been affected. Stay on them, and negotiate with them, and let them help you. And I’m sure they will rise to the occasion to do so.”

If they don’t, she says, then as soon as the health crisis is over – get a new credit card.

Living Paycheck-to-Paycheck? DON’T Deplete Your Checking Account.

Almost half of the people in the country live paycheck-to-paycheck, Orman says. Many people have about $1,000 (or less) in the bank.

If that’s your situation – don’t spend that money.

“Keep that $1,000,” Orman says. “Don’t touch it.”

Instead, she says, put your groceries and essential items on your credit card, and pay the minimum payments.

You may need the cash, she says. “There are a lot of things you can’t put on a credit card.”

Worst case scenario, she says, you could declare bankruptcy to wipe out the credit card debt.

“Since we have no idea, really, when the virus is going to be under control, and when everybody gets to go back to living normal lives, you have to hope for the best, and expect the worst,” Orman says. “Keep your wits about you.”

As information about the coronavirus pandemic rapidly changes, PEOPLE is committed to providing the most recent data in our coverage. Some of the information in this story may have changed after publication. For the latest on COVID-19, readers are encouraged to use online resources from CDC, WHO, and local public health departments. To help provide doctors and nurses on the front lines with life-saving medical resources, donate to Direct Relief here.

Source: Read Full Article